Confusing Signals Mean It’s Hard to Be an Economist Right Now

Highland Global Advisors’ Midyear Update to the Economic Outlook

If you’re still using traditional economic cycle analysis to understand where we’re headed—you may want to update your toolkit.

Since the 1970s, the basic playbook has been this: when growth slows, inflation eases, and the Fed steps in with a dose of counter-cyclical medicine.

But that framework doesn’t hold up in the current moment. We’re not in a conventional cycle. We’re in a reordering. And the reordering has a name: the Trump Economy.

The Trump economy relies less on income taxes to fund the government and leans heavily on tariff revenues. Tariffs function much like a consumption tax—everyone in the U.S. pays them equally, regardless of income. In that sense, the Trump economy moves the U.S. a step closer to the European model, where government revenue depends more heavily on broad-based sales taxes.

Now before we dive into the Trump effect, a quick nod to the traditional data dashboard.

GDP: Okay Today, Cloudy Tomorrow

The economic consensus for 2025 is that we’ll land the year at roughly 2% growth in the United States—just a touch below potential. That’s manageable. But the forecasts for 2026 show a wide dispersion, mostly lower, largely because of expected weakness in consumer demand and still-sticky price pressures.

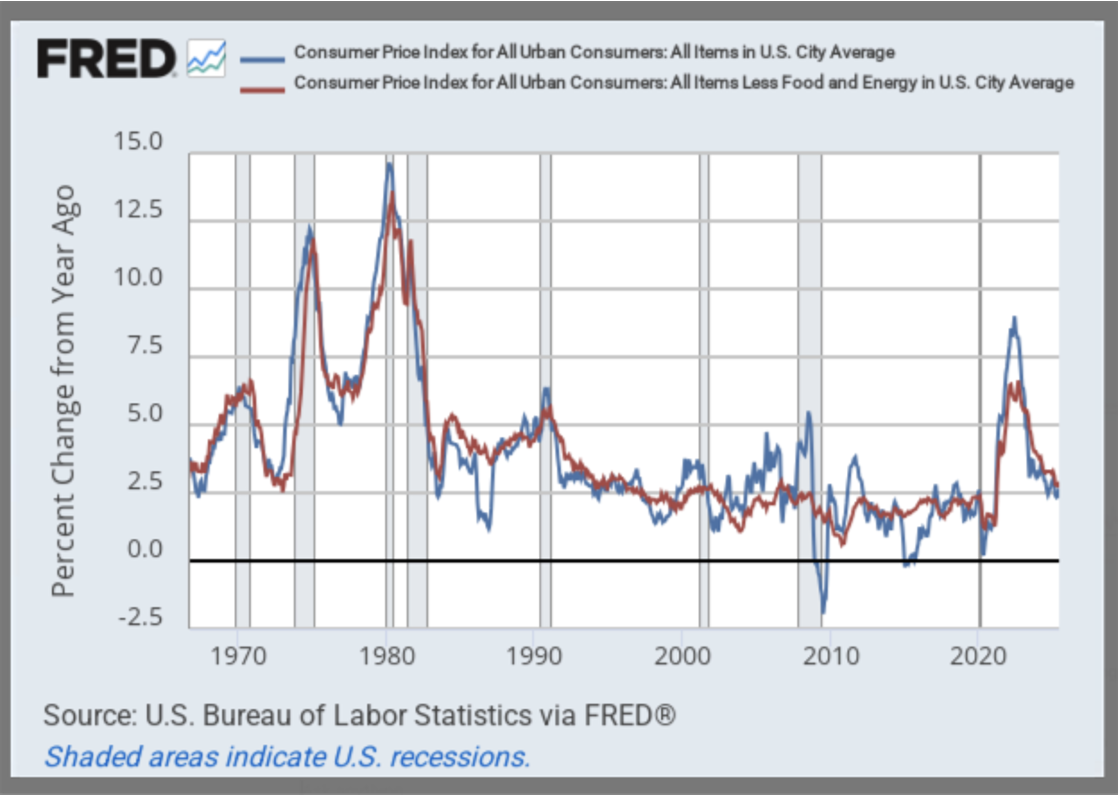

Inflation: The Dog That Hasn’t (Yet) Barked

Here’s the puzzle: tariffs have gone up, and yet CPI inflation has been oddly stable—hovering around 2.5–2.7%. That’s above the Fed’s target, but far below what most economists (me included) expected.

So what gives? Three theories:

Corporate shock absorption – Companies like GM and Stellantis are eating the cost increases and reporting margin compression (if this continues it will get passed along to us through lower returns on our 401(k)s).

Inventory games – Firms frontloaded imports ahead of tariff hikes, softening the immediate blow.

Exporter givebacks – Foreign companies are absorbing some of the hit (least likely, given that we already see rising import prices).

But don’t get too comfortable—tariff hikes still have more room to run, and inflation remains a key upside risk in the months ahead. I expect inflation to rise in the months ahead.

The Fed: Drama in Three Acts

What will Powell do? Let’s call it Washington’s version of ancient Greek theater, with Trump and Powell reprising the roles of antagonist and tragic hero (I’ll let our readers decide which is which). Markets are pricing in modest Fed cuts, which seems reasonable if you believe, as I do, that inflation is far from vanquished.

The One Big, Beautiful Bill Act (BBB): The Highland Global Advisors Elevator Pitch Edition

In 30 seconds or less, the BBB:

Cuts benefits for low-income households;

Cuts taxes for everyone;

Biggest gains from tax cuts flow to the top of the income distribution.

Adds $3.4 trillion to the national debt over 10 years, per the CBO.

By 2034, that’s a 7–8 point increase in the debt-to-GDP ratio over the period, which already clocks in at 122%. (My inner IMF economist still remembers when 60% was the red line where we started to worry.)

BBB Winners:

Industrial firms with capex appetites (thanks to full expensing).

Defense contractors (hello, Pentagon budget boost).

Coal and gas infrastructure (rebates + streamlined permitting).

Domestic metals (steel, aluminum, copper get tariff shields).

BBB Losers:

Hospitals and health systems (Medicaid cuts).

Consumer staples and retail (tariff pass-through + weaker demand).

Clean energy (subsidies clipped, competition from fossil fuel incentives).

All else equal, I expect the BBB to stimulate financial markets in the near term, because upper-income tax cuts = asset price support.

Tariffs: A Regressive Revenue Engine

Today the EU and U.S. agreed to a new tariff deal. Even before this deal, the effective tariff rate in the United States is now ~16%, heading toward 20%. And yes, that’s high. But here’s the twist: those same tariffs may raise $2.8 trillion over 10 years, according to the CBO. That’s not nothing.

Tariffs may partially replace income taxes as a revenue driver in this new regime. But make no mistake—tariffs are a tax. And they hit lower-income households hardest because they function as a flat consumption tax.

Pressure Points: The Downstream Impacts

Cuts to SNAP and Medicaid (phased in after 2026) plus regressive tariffs mean real pain for the bottom half of the income distribution. That hits:

Consumer staples

Discount retail

Restaurants

Apparel

Agriculture

So Where Does That Leave Us with the Trump Economy Outlook?

Let me put on my consultant hat and try to stitch this together:

The cycle isn’t dead, but it’s buried under a pile of policy changes. Don’t expect the usual indicators to give you the full picture.

BBB = major fiscal expansion funded by debt and partially offset by tariffs. It’s stimulative in the short term, distortionary in the medium term.

Tariffs are taxes. They raise revenue, reduce margins, and squeeze consumers. You’ll feel it either in your wallet or your 401(k).

The short-term outlook favors asset prices. High-income households will spend and invest more. The SNAP/Medicaid cuts don’t kick in until after the midterms.

And yes, I’m bullish on Alaska. Murkowski secured whale ship tax rebates. You can’t make this stuff up.

Until next time—keep your eyes on the policy signals, and don’t let the alphabet soup boil over.